FintechZoom: How Much House Can I Afford?

When considering buying a home, your income-to-debt ratio plays a crucial role. This ratio compares your monthly income to your total monthly debt payments, including credit cards, car loans, and any other obligations. Lenders typically look for a ratio below a certain threshold to ensure you can manage additional mortgage payments without financial strain.

Credit Score Impact on Mortgage Rates

Your credit score significantly influences the mortgage rates you qualify for. Higher credit scores often result in lower interest rates, translating into more affordable monthly payments over the life of the loan. Understanding how your credit score affects these rates empowers you to take steps to improve it before applying for a mortgage.

Financial Tools for Home Affordability

Mortgage Affordability Calculator

Utilizing a mortgage affordability calculator is essential. It takes into account your income, debts, desired down payment, and current mortgage rates to estimate the maximum home price you can afford. This tool helps you set realistic expectations and narrow down your search within your budgetary constraints.

Home Buying Budget Calculator

A home buying budget calculator provides a detailed breakdown of all expenses associated with purchasing a home. It factors in not only the mortgage principal and interest but also property taxes, homeowner’s insurance, and potential homeowner association fees. This comprehensive view ensures you’re prepared for all financial aspects of homeownership.

Key Considerations in Home Purchase

Importance of Down Payment

Saving for a down payment is crucial as it affects the amount you need to borrow and influences your mortgage terms. Higher down payments often lead to lower monthly payments and can even impact the interest rate offered by lenders. Understanding the ideal percentage for a down payment helps you plan and save accordingly.

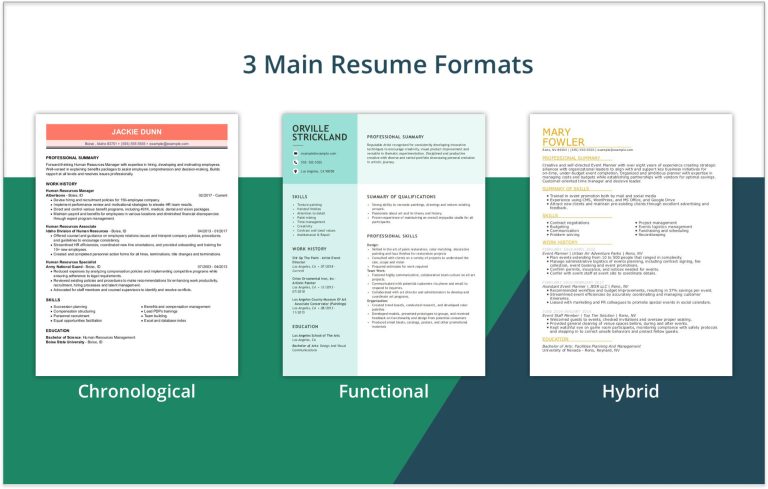

Types of Mortgage Loans Explained

There are various types of mortgage loans, each with its own terms and conditions. Fixed-rate mortgages offer stability with consistent monthly payments, while adjustable-rate mortgages ARMs may start with lower rates that adjust over time. Choosing the right type depends on your financial situation, risk tolerance, and future plans.

Navigating the Mortgage Approval Process

Steps to Improve Credit Score Before Applying for a Mortgage

Improving your credit score before applying for a mortgage can potentially save you thousands of dollars in interest over the life of your loan. Simple actions like paying down debt, correcting errors on your credit report, and maintaining consistent payment histories can have a significant positive impact on your creditworthiness.

Common Mistakes to Avoid When Buying a Home

Avoiding common pitfalls in the home buying process is crucial. These may include overestimating your budget, skipping home inspections, or not securing pre-approval for a mortgage. Learning from others’ mistakes can help you navigate the process smoothly and avoid unnecessary financial stress.

Also Read: Drew Brees’ Hair Makeover: A Social Media Sensation

Conclusion

“FintechZoom: How Much House Can I Afford?” equips prospective homebuyers with the knowledge and tools needed to make informed decisions about one of life’s most significant investments. By understanding the financial factors that determine affordability, leveraging tools like affordability calculators, and navigating the mortgage approval process effectively, individuals can confidently embark on the path to homeownership. This guide ensures that you not only find a house you love but also one that fits comfortably within your financial means, setting the foundation for a secure and fulfilling future.